McKinsey's latest report: China market in the next five years

Will promote the recovery of the high-end jewelry and luxury watch industry

McKinsey & company, a multinational consulting company in China, released a market research report outlining the market prospects of the premium jewelry, premium and Ultra Luxury Watch industries in the next five years.

McKinsey said that these are two industries of considerable scale, which occupy the main share of the global luxury market, with total annual sales of more than 330billion US dollars.

During the epidemic period, the sales of high-end jewelry industry decreased by 10-15%, and the sales of high-end and ultra luxury watches decreased by 25-30%. However, McKinsey expects these two industries to recover in the coming years.

Specifically, due to China's continued restrictions on international travel and the increase in the number of domestic duty-free zones, the growth is expected to be driven by young consumers and China's domestic market. At present, Asia accounts for 45% of global jewelry sales and 50% of global watch sales.

In the next five years, the Asian market led by China is expected to further grow. The sales growth of high-grade jewelry will be between 10% and 14% per year, and the sales growth of luxury watches will be about 4% per year.

McKinsey estimates that the overall growth rate of the global jewelry market will be between 3% and 4% per year in the next five years.

Among them, branded high-grade jewelry is about three times the growth rate of the overall jewelry market. From 2019 to 2025, branded high-grade jewelry will grow at a compound annual growth rate of 8% to 12%. In the future, driven by digital channels and sustainability, mature brands will have a larger market share.

McKinsey expects three major changes in the boutique jewelry industry:

digitization:

McKinsey estimates that global online sales may grow at a rate of 13-21%. However, it reminds that industry participants must carefully consider the transformation of digital channels to avoid underestimating the importance of humanized digital experience.

In fact, online consumers expect the same level of customer service and attention to detail as stores. By 2025, about 80% of shopping activities will still be conducted in physical stores, so cross channel seamless experience is necessary.

Sustainability:

McKinsey estimates that 20-30% of global jewelry sales will be affected by sustainable oriented consumers by 2025. Therefore, market participants must embrace sustainability to win the trust of young consumers and develop leadership.

New jewelry brands are emerging:

Premium jewelry currently accounts for only 20% of the total market sales. However, the market share of luxury brands is rising - it is estimated that by 2025, brand jewelry will account for 25-30% of the market share, equivalent to US $80billion-100billion.

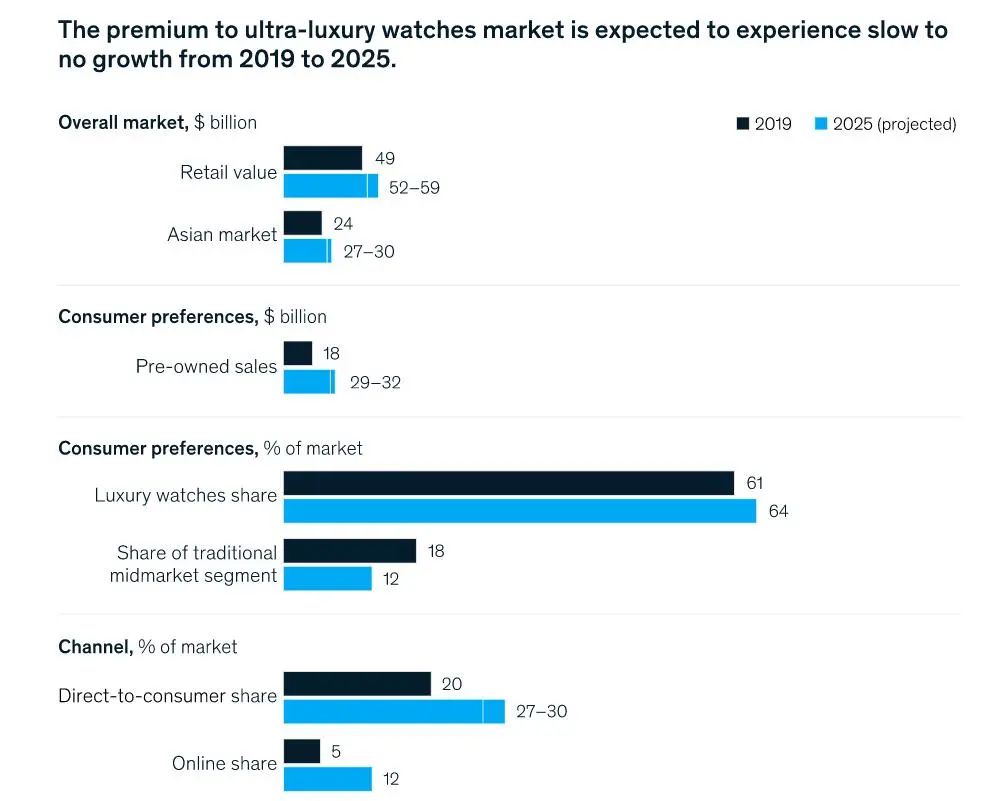

In the field of high-end and ultra luxury watches, McKinsey expects a relatively slow growth rate. From 2019 to 2025, this market will grow by only 1% to 3% per year.

McKinsey expects three major changes to take place in the field of high-end and Ultra Luxury Watches:

Retail channels will be comprehensively transformed:

For decades, offline retail has been the main source of revenue for the watch industry, mainly through multi brand retailers to contact customers. But now, consumers demand direct interaction with brands and expect a better online shopping experience.

For this reason, watch manufacturers will expand the scope of their retail business and ensure the customer experience through dynamic Omni channel means. This is a major challenge for both brands and retailers. It is estimated that by 2025, the annual sales of US $2.4 billion will be transferred from multi brand retailers to the brand itself.

Mid tier market will shrink:

Under the fierce competition between digital native brands and fashion brands, as well as the squeeze of the rapidly growing category of smart watches, the mid-range market in traditional watches is facing increasing pressure. Many consumers in this segment are now turning to luxury goods.

McKinsey estimates that unless traditional mid-range brands respond, the total sales of mid-range watches may decrease by $2.5 billion by 2025.

Usher in a new era of used watches:

McKinsey said that second-hand watches will become the fastest growing part of the industry. It is estimated that by 2025, the sales of second-hand watches will reach US $29billion to US $32billion. Major brands need to strive to seize the opportunity from this change, and professional e-retailers need to improve their business models in the increasingly fierce competition.